The Deceptive Appeal of Buy Now Pay Later

Anonymous | July 7, 2022

Buy Now, Pay Later (BNPL) companies like Affirm, Klarna, and Afterpay offer consumers with the enticing option to pay for their online purchases in interest-free installments. The BNPL industry has grown rapidly in the past several years, accelerated by the increase in online shopping. Many new players are joining the scene, with Apple Pay Later set to launch in Fall 2022. With this, consumers can now split large costs into smaller, more manageable payments with a click of a button. You can now pay use Affirm to purchase a laptop, buy a brand new wardrobe through Klarna, and even finance your groceries through Afterpay.

At the same time, since consumers now have multiple options to pay over time, it can encourage them to spend impulsively and buy items they cannot afford. It has now become an issue where people are buying everyday household items in installments. Unlike credit cards, the BNPL industry is largely unregulated. They operate outside the legal definition of a loan product and are not subjected to certain US consumer finance regulations (Nguyen, 2021). The terms for each company vary – with some including late fees but not interest, some reporting to credit bureaus and some not. For example, while Afterpay doesn’t charge interest, it collected $64 million in late fees from users in the past 12 months. (Fussell, 2021).

In order to understand the ethical challenges involved, we can apply the Belmont Principles. In terms of respect for persons – we can see that BNPL does not explicitly provide informed consent to their users. For one, the services are deceptively marketed as a payment option, rather than the loan paid in installments that it is. There is also a major lack of transparency in the BNPL process. On Klarna’s website, it simply states “Split the cost of your purchase into 4 interest-free payments, paid every 2 weeks. No interest. No catch.” Affirm explains how their process works in three steps: 1) Go Shopping 2) Choose Your Payment Terms 3) Make Your Payments. Both fail to provide adequate information and explain if and how a soft credit check is performed or the consequences of missing or paying an installment late. As a result, users are unaware of the full terms and conditions before agreeing to these installment loans.

The principle of beneficence states that any research should aim to maximize possible benefits and minimize potential harms. While the industry does provide a service to users, allowing for a supposedly interest-free alternative to those without a credit card, the companies are at the end of the day, profit driven. Without regulation in place, BNPL companies are free to impose fees and apply tactics that may encourage consumers to overspend and accumulate debt without consequences.

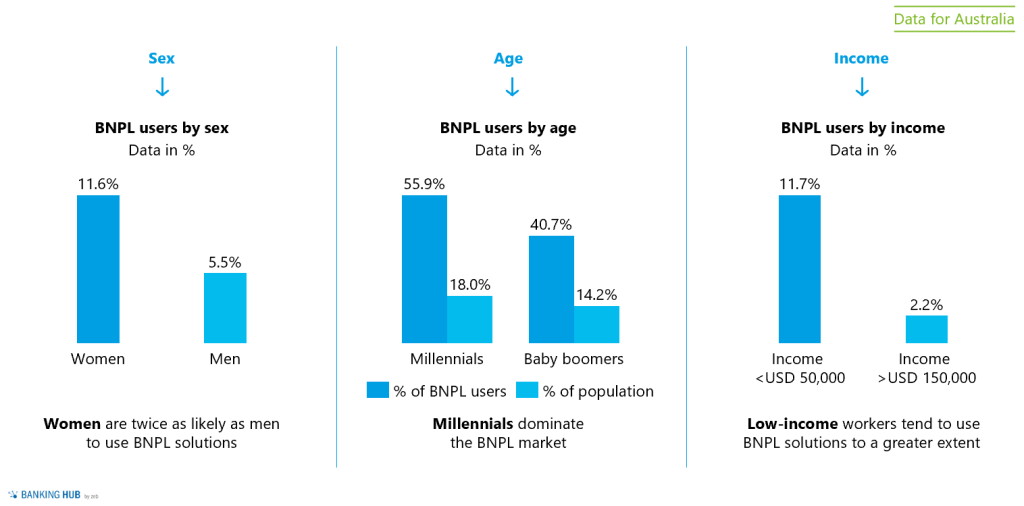

The third principle of justice advocates for fair treatment for all. Research has found that BNPL users have consisted mostly of younger consumers, as well as those who are low income. At the same time, BNPL is “heavily marketed influencers and brands on TikTok and Instagram” (Bote, 2022). There are currently no safeguards in place for children or younger users, when they are already vulnerable with little credit history and limited financial literacy. This leaves the younger generation susceptible to the dangers of increasing debt involved with BNPL services. Users can easily open multiple BNPL lines to pay for purchases, as opposed to the more complex process of applying for a credit card, getting approved, and then being able to make purchases.

While BNPL services shows no signs of stopping, governments have finally taken notice and have been beginning to take steps towards change. In November 2021, the House Financial Services Committee held a hearing where consumer advocates called for “tighter regulation and more data on how often users default, the potential long-term impact on credit scores, and tighter rules around credit approval” (Fussell, 2022). The Consumer Financial Protection Bureau (CFPB) recently issued a series of orders to five companies collect information on the risks and benefits. As the industry continues to grow, governments need to take action to safeguard consumers and prevent the continued overspending and accumulation of debt.