Tesla Insurance Driver Safety Score: Potentially Save a Quick Buck, but at What Cost?

Ethan Nguonly | July 7, 2022

Teslas are well known for their state-of-the-art monitoring abilities, from location data, battery usage, pressure monitoring, and sentry mode recording. Tesla also offers car insurance for its users at a discounted rate and insured drivers also have the option to enroll in real-time driver safety monitoring. Through this program, Tesla uses its built-in logging and monitoring system in order to evaluate how safely a driver drives and generates a Driver Safety Score from this data. Drivers start off with a safety score of 90, which can go up or down depending on the driver’s behavior, such as speed of braking, sharpness of turns, etc.

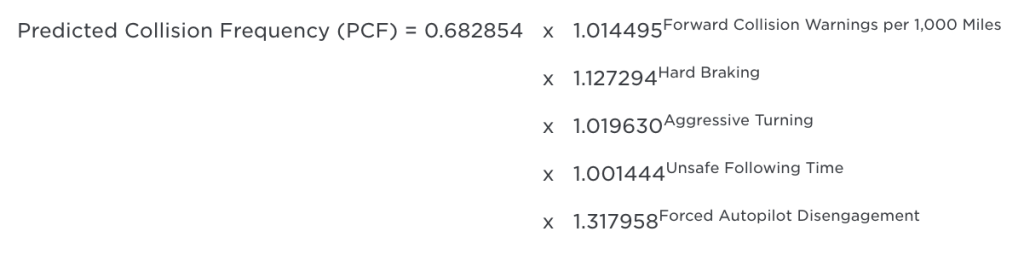

The five safety factors that are used to evaluate a driver’s safety score are Forward Collision Warnings per 1,000 Miles, Hard Braking, Aggressive Turning, Unsafe Following, and Forced Autopilot Disengagement. These metrics are used together to compute a Predicted Collision Frequency score as follows:

The PCF is then converted into a 0 to 100 Safety Score using the following formula:

Safety Score = 115.382324 – 22.526504 * PCF

A driver’s monthly insurance premium is then determined based on their safety score for the previous month. This allows Tesla to offer discounts to users based on their driving habits, incentivizing and rewarding users for driving safely. On the other hand, users who are deemed to not be safe drivers, would have their insurance premiums increased. Tesla has stated it estimates those deemed to be “average” drivers would save between 20% to 40% on their monthly premiums compared to competitor insurance offerings, while “good” drivers would save between 30% to 60%.

Other major car insurance companies have also started offering telematics-based insurance rates as well. However, where Tesla beats its competitors is its increased transparency of what metrics are used to evaluate drivers and how. While Tesla openly provides its driver safety score formula, other auto insurance companies do not. Some argue that Tesla’s transparency about how it evaluates drivers allows the system to be easily gamed, while others praise Tesla for being more open and informing drivers how their driving data will be used.

While lower insurance premiums and safer drivers sound like a win-win situation for all parties, this type of continual vehicle monitoring system does raise serious concerns about user privacy. For example, what else is this data being used for? What if this data were to be leaked or sold to a third party such as an employer, who could then make the decision not to hire an individual based on their driving behavior? Given the sophistication of Teslas, what other data is being collected outside of the metrics Tesla has openly outlined? Greater transparency and education about data collection, usage, and retention of vehicle telematics are needed as driver-based insurance programs become more widely available. For now, whether or not to opt into a real-time monitoring-based car insurance program is a personalized choice. Let’s just hope that the decision to opt-in now does not have unexpected lasting consequences in the long run.

Tesla states that if you sell your vehicle, your previous driver safety score will not be used for a new Tesla vehicle that you purchase.

References

https://www.tesla.com/support/safety-score

https://www.vice.com/en/article/akvwge/tesla-drivers-say-they-can-easily-cheat-teslas-safety-score