Among the many, many projects and papers that have been submitted since the course’s inception, this is only a sampling of the topics you’ll find. These works have been chosen to specifically showcase the diversity of topics and ideas that data scientists are studying, not just your typical ‘breach of security protocol’.

Moby Dick Plays Games: How Captain Ahab Made His Fortune – Gunnar Kleemann, Tom Kunicki

The mobile gaming market has become a major source of tech-based revenue. In North America alone there were 141.9 million mobile game players who generated $4.63B in annual revenue in 2014 (EEDAR 2014). Two models for game revenue generation are; 1) the premium game model where the gamer pays outright for a game and 2) the freemium model (Free-to-play/in-app-purchase games (F2P)), which offers free access to games but the game earns a profit by selling upgrades, shortcuts and recharges within the game. Notably freemium games can generate large profits if they successfully monetize their product.

Mobile App Monetization – Sharon Lin, Kunal Shah

Since the introduction of the first iPhone in 2007, the adoption of smartphones has dramatically increased across the world. Compared to laptop or desktop, smartphones provide more ease to users in accessing the internet and the contents they need, while being much more convenient to carry. Mobile Analytics by comScore have shown that mobile usage has been increasing faster than desktop usage. And as of January 2014, mobile has officially overtaken desktop in terms of number of users. Even internet giants such as Facebook and Google, which together account for a large amount of internet usage across the world, have changed their launch strategies for their core products to be mobile-first.

About the Author: I am the senior analyst of the Analytics and Big Data team at Okta, a cloud security and identity management start-up in San Francisco, leading product analytics and data science projects. Previously, I have worked in several analytics roles at different start-ups, ranging from mobile gaming to marketing analytics, in the Bay Area. I received my undergraduate degree in Statistics and Economics from UC Berkeley, and completed my Master of Data Science degree at UC Berkeley in 2015.

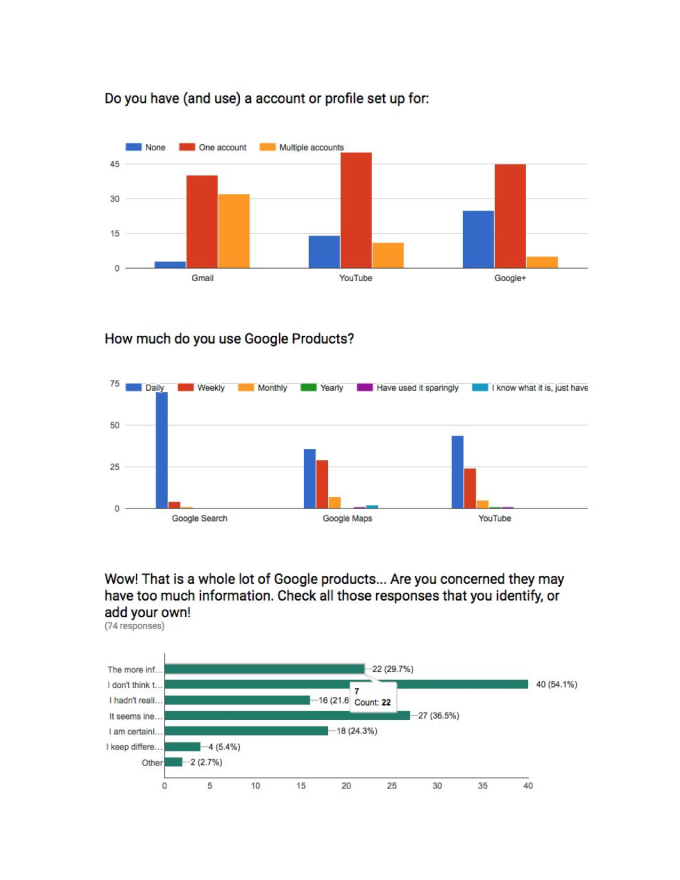

“Reality” by Google – Ankit Tharwani, Annalaissa Johnson, Guillermo Monge

Over the past fifteen years, Google has developed an exponentially growing impact on our methods of searching for, gathering, and relaying data. As the company grew from a small search engine querying websites for mildly relevant data to a technology giant that offers applications for everything from thermostats to streaming video, Google managed to claim the most coveted spot in the industry for how the public incorporates data into their lives.

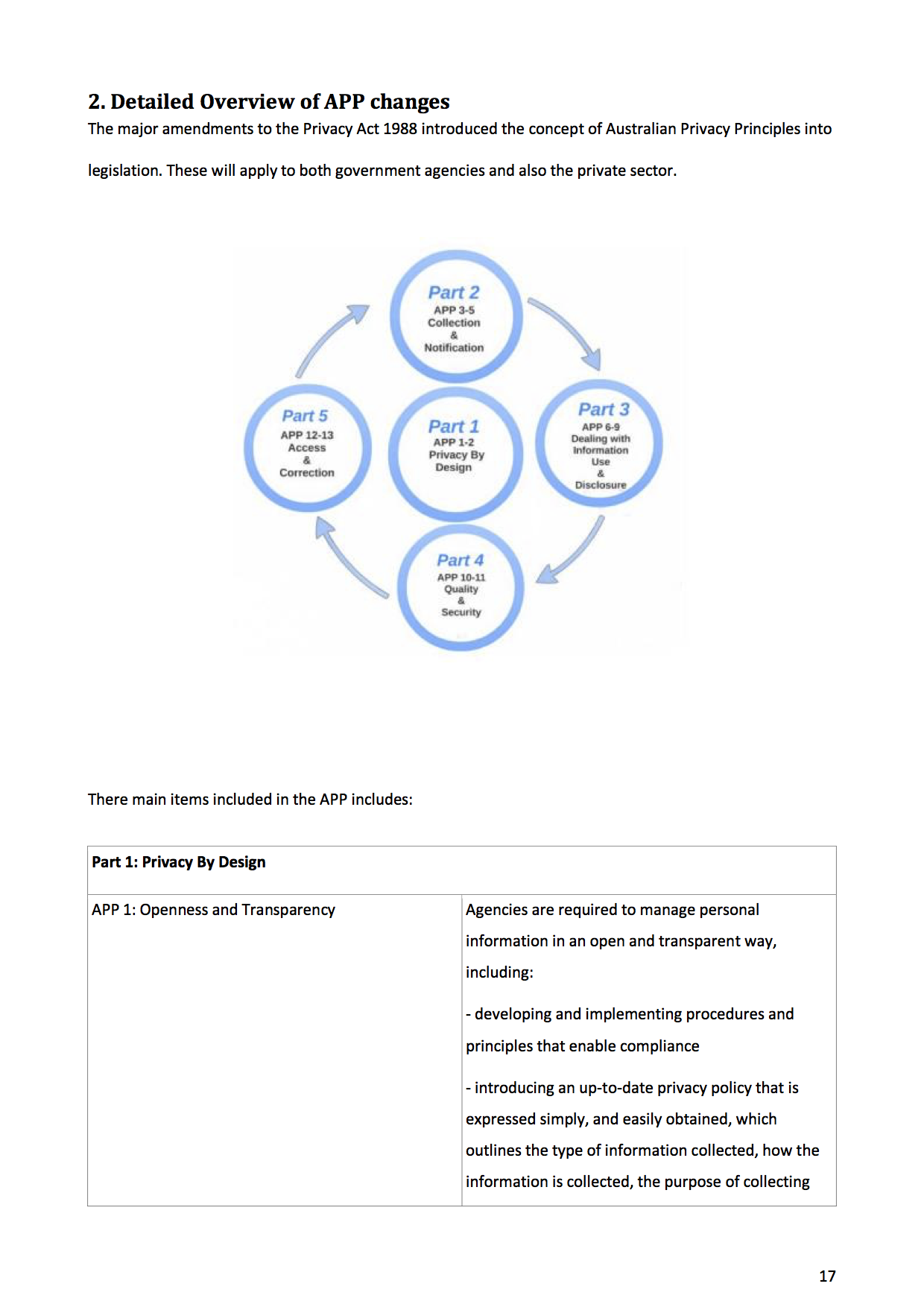

Australian, European and US Privacy Laws – How Do They Stack Up? – Simon Macarthur

In March 2014, the new Australian Privacy Principles (APPs) came into effect. These replaced the now defunct National Privacy Principles and Information Privacy Principles and apply to all Australian organisations and the Australian Government agencies. These are the largest reforms in more than 10 years, and had wide reaching implications for all data collection, storage and usage activities. As we live in a global world where physical borders do not mean as much in the virtual world of the Internet, this paper will not only review these new APPs, but it will then also compare and contrast these to similar privacy principles put in place in both the USA and Europe. The final outcome will be a clear cut understanding of the difference and similarities between how personal information is governed in different countries.

In March 2014, the new Australian Privacy Principles (APPs) came into effect. These replaced the now defunct National Privacy Principles and Information Privacy Principles and apply to all Australian organisations and the Australian Government agencies. These are the largest reforms in more than 10 years, and had wide reaching implications for all data collection, storage and usage activities. As we live in a global world where physical borders do not mean as much in the virtual world of the Internet, this paper will not only review these new APPs, but it will then also compare and contrast these to similar privacy principles put in place in both the USA and Europe. The final outcome will be a clear cut understanding of the difference and similarities between how personal information is governed in different countries.

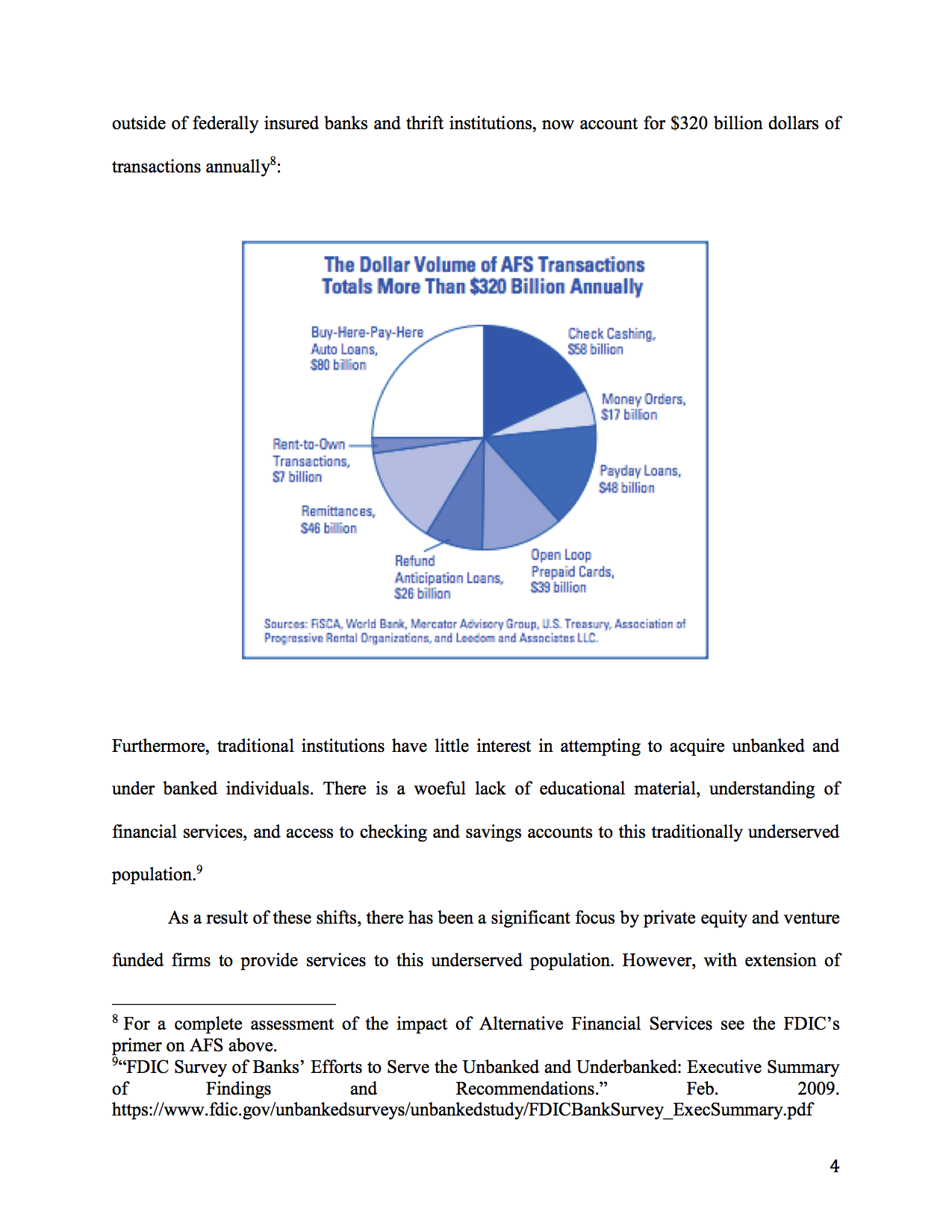

New Credit: How Data Science is Changing Lending – James Jasper, Jared Maslin

Since the financial crisis, low-income growth and persistent poor credit has limited many from achieving stability in their lives. These dual limitations has led to their being 50 million individuals deemed “unscorable” by traditional credit methods – effectively freezing them out of the market for home loans, car loans, and access to credit cards. Alongside these developments, technical hurdles to accessing social networks and other methods of rating an individual’s ability to repay a loan have decreased. Data science is now being used to extend a variety of alternative credit instruments to these underserved individuals.