Credit Scoring Apartheid in Post-Apartheid South Africa

By Anonymous | October 28, 2022

More than 20 years after the end of apartheid in South Africa access to credit is still skewed by race towards the white community of South Africa. Apartheid was a policy or system of segregation or discrimination with the ruling minority whites enjoying more access to resources at the expense of the majority black in South African prior to 1994. Nonwhites included blacks, Indians and coloureds with blacks or African as the majority. This meant that black South Africans were excluded from certain educational institutions, neighborhoods, type of education. This resulted in Africans earning less a third of white South Africans.

Financial institutions in South Africa now use Big Data to develop credit models or algorithms to make credit decisions. It is argued that the use of Big Data and related credit models eliminate human bias in their decision. This is critical in South Africa as such decisions are more likely to be made white person and so any system that purports to eliminate human bias will be seen in good light by Africans. The South Africa credit market shows that Africans are either denied mortgages or receive unfavorable terms like high interest rates or lower mortgage amounts. This is similar for African South African owned businesses who have access to fewer and lower amount of loans.

Access to credit enables investment in human capital and businesses and has the potential to reduce inequality in society and drive economic growth. To support growth for all, South Africa through the bill of rights enshrines the constitutional goals of achieving human dignity, equality for all races and freedom. Several laws have been passed to give effect to these constitutional goals and to enforce equality and prevent discrimination, such as, the Employment Equity Act and the Promotion of Equality and Prevention of Unfair Discrimination Act (PEPUDA). These laws do not apply to the data used in credit scoring and leaves a gap in the application of Big Data credit decisioning.

These credit scoring models are either build using generic statistical analysis or machine learning models. The models will essentially be based on historical credit related data to determine the credit worthiness of individuals. These would include aspects like the amount of credit that can be extended to the person, the period the loan can be granted for, the interest rate payable on the loan and the type and need of collateral for the loan. These models will place significant value on traits in the available Big Data universe using weights. These traits will be factors like education, level and source of income, employment type (formal or informal), assets owned, but all of this will be on a data set made up of predominantly white people given the history of the country. By implications the modelled traits resemble the way of life of white people and how they have structurally benefited from apartheid. Credit models used for all races will largely be a byproduct of apartheid.

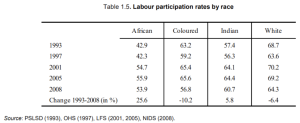

The table below is an illustration of the change in labour force participation by race since 1993 a year before apartheid was formally abolished. There is a significant increase in labour force participation for Africans (Blacks) from 1993 to 2008.

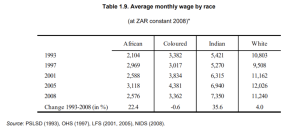

The table below shows average income by race and its clear that Africans have continued to receive less than a third of the income received by white people 1993 – 2008 even though they have seen an increase income..

The racial implications of credit apartheid are observed in several areas of everyday life. White South Africans constitute less than 10% of the population but own more than 72% of the available land and 37% of residential property. 69% of white people have internet access, compared to just 48% of black. 53% of entrepreneurs are white and with only 38% African. Black South Africans owned only 28% of available listed shares.

To reduce this bias, part of the solution is to build models for credit scoring based on data from digital platforms and applications that resembles all consumer behavior. This be done by combining data from multiple sources, like airtime usage, mobile money usage, geolocation, bills payment history, and social media usage. This could help to eliminate Big Data bias by race as it would result in new models that are more inclusive. The models can also introduce different weights to different population groups and income level categories. This would improve the fairness of the credit scoring models. It is also an opportunity for regulators to look closely at these models to reduce racial bias which perpetuates apartheid and by implication racial inequality.

Such changes would ensure that the credit scoring models are not only based on data from credit bureaus which is mainly based on white South Africans who have always had access to credit.

Positionality

I’m a black South African raised in a low-income home. At the beginning of my career, I was only awarded 50% mortgage because I had no credit history and probably because of my racial classification.

References

- https://www.oecd.org/employment/emp/45282868.pdf

- https://www.marklives.com/2017/09/media-future-internet-access-in-south-africa-has-many-divides/#:~:text=%E2%80%9COver%20two%2Dthirds%20of%20white,%2C8%25%20of%20coloured%20users.

- https://www.gov.za/sites/default/files/gcis_document/201903/national-action-plan.pdf

- https://mg.co.za/article/2011-12-09-who-owns-what-by-race/

- https://www.news24.com/citypress/personal-finance/does-your-race-affect-your-interest-rate-20190315