Alternative credit scoring – a rocky road to credit

By Teerapong Ninvoraskul | October 29, 2021

Aimee, a food truck owner in the Philippines, was able to expand her business after getting access to a loan. She opened a second business where she sells beauty products on the side. Stories like Aimee were common in the Philippines, where 85% of the formal Filipino population is outside of the formal banking system.

“Aimee makes money, she’s clearly got an entrepreneurial spirit, but previously had no way of getting a forma bank to cooperate” said Shivani Siroya, founder and CEO of Tala, a fintech company providing financial access to individuals and small businesses.

Loan providers usines alternative credit scoring like Tala is spreading fast through developing countries. In just a few years China’s Ant Financial, an affiliate of Alibaba Group, has built up an extensive scoring system, called Zhima Credit (or Sesame Credit), covering 325m people.

Alternative credit scoring could be viewed as a development in building a loan-default prediction system. Unlike the traditional credit score system which determines consumers’ possibilities of default using financial information such as payment history, alternative scoring models use their behaviors on the Internet to predict default rates.

Personal information such as email, devices used, time of the day when browsing, IP address, purchase history, etc. are collected. These data are found to be correlated with loan default rate.

Alternative credit scoring

Financial access for the unbanked

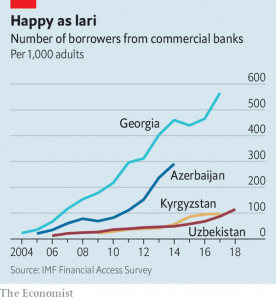

Historically, lower income is the market segment which is too costly for traditional banking to serve, given its small ticket size, expensive infrastructure investment required, and high default rates.

For this market segment, traditional credit-scorers have limited data to work with. They could use payment records for services that are provided first and paid later, such as utilities, cable TV or internet. Such proven payment data are a good guide to default risk in the absence of credit history. In most cases, this specialized score is the only possible channel to get credible scores for consumers that were un-scorable based on traditional credit data alone.

In smaller and poorer countries with no financial infrastructure, credit-scorers have even more limited financial data to work with. Utilities are registered to households, not individuals, if they are registered at all. Thanks to high penetration of pay-as-you-go mobile phones among the poor, rapidly emerging alternative lenders are able to look at payment records for mobile phones.

New breed of startups spot opportunities to bring these data-driven, algorithm-based approaches to offer services to individual and small businesses. Tala, which operates in India, Mexico, the Philippines and east Africa, says it uses over 10,000 data points collected from a customer’s smartphone to determine whether to grant a loan. It has lent more than $2.7 billion to over 6 million customers since 2014.

With inexpensive cost structure and lower loan default rates, these fintech startups achieve attractive investment returns and are able to provide cost-efficient financing to the previously unbanked and underbanked.

Lack of transparency & fairness challenges

Despite benefits in expanding financial inclusion, alternative credit scoring presents new challenges that raises issues of transparency and fairness.

First, it is harder to explain to people seeking credit than traditional scores. While consumers generally have some sense of how their financial behavior affects their traditional credit scores, it may not always be readily apparent to consumers, or even to regulators, what specific information is utilized by certain alternative credit scoring systems, how such use impacts a consumer’s ability to secure a loan or its pricing, and what behavioral changes consumers might take to improve their credit access and pricing.

Difficulty in explaining the alternative scores is further amplified by the secretive “blackbox” roles that alternative scoring systems play as competitive edges against each other in producing better default predictions for lenders.

Second, improving their own credit standing is more difficult. Traditional credit scoring is heavily influenced by a person’s own financial behavior; therefore, clearer targeted actions to improve one’s credit standing, i.e., punctual monthly mortgage payments.

However, most alternative data may not be related to a person’s own financial conduct, making it beyond consumers’ control to positively influence the scores. For example, a scoring system using your social media profile, or where you attended high school, or where you shop to determine your creditworthiness would be very difficult for you to take actions to positively influence.

Third, big data could contains potential inaccuracies and biases that might lead to discrimination against against low-income, therefore, failing to provide equitable opportunity for the underserved population.

Using some alternative data, especially data about a trait or attribute that is beyond a consumer’s control to change, even if not illegal to use, could harden barriers to economic and social mobility, particularly for those currently out of the financial mainstream, i.e., Landlords often don’t report rental payments that million people make on a regular basis, including more than half of Black Americans.

Predicting the predictors

Ultimate goal of the alternative scoring system is to predict the likelihood of timely payment, which are incorporated in the predicting factors within the FICO traditional scoring system. One would argue that alternative scoring is simply an attempt to use correlations between these non-traditional characteristics and payment history to come up with the creditworthiness prediction.

It’s arguably whether these alternative models could match the prediction power of actual financial records, and whether it is simply a transitional road to the traditional model while financial payment records are not available for the underserved population.

References:

- www.economist.com/international/2019/07/06/a-brief-history-and-future-of-credit-scores

- Big Data: A tool for inclusion or exclusion? Understanding the issues (FTC Report)

- CREDIT SCORING IN THE ERA OF BIG DATA Mikella Hurley* & Julius Adebayo** 18 YALE JL & TECH. 148 (2016)

- Is an Algorithm Less Racist Than a Loan Officer? New York Times, Sep 2020

- What Your Email Address Says About Your Credit Worthiness, Duke University’s Fuqua School of Business, Sep 2021,

- Data Point: Credit Invisibles, The Consumer Financial Protection Bureau Office of Research

- On the Rise of FinTechs – Credit Scoring using Digital Footprints

- Zest AI Comments on The Federal Guidance For Regulating AIts-on-the-federal-guidance-for-regulating-ai

- MEMORANDUM FOR THE HEADS OF EXECUTIVE DEPARTMENTS AND AGENCIES FROM: Russell T. Vought Acting Director