Do the financial markets care about data privacy?

By Finnian Meagher | October 24, 2022

While long-term outperformance of large tech companies may indicate that privacy policy mishaps aren’t priced into stock prices, recent stock performances and relevant pieces of research may suggest otherwise – companies may be forced by the demands of the market and shareholders into adopting more rigid privacy policy practices.

The data privacy practices and policies of companies, especially large tech and social media organizations, are often scrutinized by the public, academics, and government regulators. However, as these companies have seen years of significant outperformance over the rest of the market, as exemplified by the below chart of the FAANG ETF (Facebook, Apple, Amazon, Netflix, and Google), it begs the question: do the financial markets care, and if so, what is the impact of negative press about privacy on market sentiment and stock prices?

Source: https://portfolioslab.com/portfolio/faang

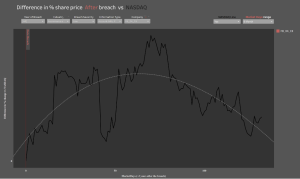

Paul Bischoff of Comparitech believes that there exists a relationship between data breaches and falls in company share prices, including an average share price fall of -3.5% and underperformance of -3.5% compared to the NASDAQ in the months following a data breach. Bischoff observes that “in the long term, breached companies underperformed the market,” with share prices falling -8.6% on average one year after a data breach. Bischoff also notes that more severe data breaches (i.e., leaking highly sensitive information) see “more immediate drops in share price performance.” (Bischell)

However, not every data breach is equally punished. As an example of a deviation from the observations that Bischoff made, Facebook outperformed the NASDAQ after their April 2019 data breach of over 533 million people’s data:

Similarly, Harvard Business Review found that “a good corporate privacy policy can shield firms from the financial harm posed by a data breach… while a flawed policy can exacerbate the problems caused by a breach” (Martin et al.). HBS notes that firms that have high control and transparency in terms of data are “buffered from stock price damage during data breaches,” but “only 10% of Fortune 500 firms fit this profile” (Martin et al.). Additionally, it is observed that data breaches in neighboring companies within one’s industry can have a negative effect on your own company’s stock prices, but those that have strong control and transparency weather those storms better than others.

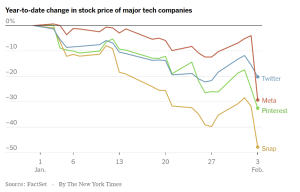

More recently, Apple announced that their privacy features could amount to billions of dollars in costs for the firm, and this rippled out into their neighboring competitors such as Twitter, Meta, Pinterest, and Snapchat. Zuckerberg, of Meta, noted that Apple’s newly introduced privacy features “could cost… $10 billion in lost sales [to Meta] this year” (Conger and Chen) which contributed to a drop of 26% of the company’s stock. Given that “people can’t really be targeted the way they were before,” (Conger and Chen) companies like Meta will have to go through a comprehensive rebuild of their business plan which could cause financial distress and ultimately share prices to drop. While there have been many factors in the general macroeconomic environment that have contributed to a pull back in share prices of large tech companies this year, implications of evolving privacy policies and practices have contributed to a sharp pullback in stock prices in the sector:

While looking at the long-term outperformance and growth of large tech companies’ financials and stock prices may lead one to take a cynical capitalist view of ‘profit over anything’ even at the expense of user privacy, research in the space and the recent exemplification of stock prices dropping amidst Apple’s change in privacy features shows that maybe these tech giants are not immune. Taking the other view, as ‘money makes the world go around,’ if markets signal the need for adoption of more strict privacy practices and policies, even without regulatory pressure, then companies could be influenced to have a more comprehensive adoption of the principals of data privacy practices.

Works Cited:

- Bischoff, Paul. “How Data Breaches Affect Stock Market Share Prices.” Comparitech, 25 June 2021, https://www.comparitech.com/blog/information-security/data-breach-share-price-analysis/).

- Conger, Kate, and Brian X. Chen. “A Change by Apple Is Tormenting Internet Companies, Especially Meta.” The New York Times, The New York Times, 3 Feb. 2022, https://www.nytimes.com/2022/02/03/technology/apple-privacy-changes-meta.html.

- “Faang Portfolio.” PortfoliosLab, https://portfolioslab.com/portfolio/faang.

- Martin, Kelly D, et al. “Research: A Strong Privacy Policy Can Save Your Company Millions.” Harvard Business Review, 30 Aug. 2021, https://hbr.org/2018/02/research-a-strong-privacy-policy-can-save-your-company-millions.