Enforcing Antitrust Laws in Tech

By Anonymous | March 14, 2019

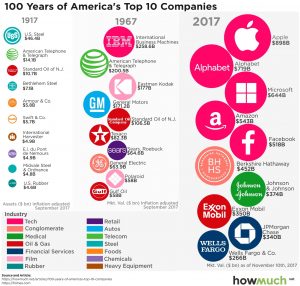

A lot of the contemporary focus on antitrust regulation with respect to the technology sector was first sparked by the Justice Department’s case against Microsoft in 2000. The case brought up questions about whether our legal framework was strong enough to oversee the quickly growing and evolving tech industry. Because technology companies are so different to companies involved in the first antitrust cases in the early 20th century, some measures and approaches have become inadequate for their proper regulation. In the long run, this may have concerning implications to consumers and market participants. So, how are large tech companies different from large monopolies of the past?

Intellectual Property

The first major difference is that tech companies’ most valuable assets are frequently their intellectual property as opposed to physical property. Given the intangible nature of intellectual property, it can be difficult to value. Regulators then have a hard time comparing one firm to another or calculating market metrics that help make decisions about going after a firm for antitrust. In the eyes of regulators, however, intellectual property is just another form of property.

Network Effects

Additionally, many technology companies depend on network effects for their services to be viable. This means that competitors of a certain service are competing for the entirety of the market instead of just a share of it. In other words, a traditional firm may sell a product and a consumer will buy that product without considering what other consumers do. However, in the example of a social media company, a potential user will consider signing up only if their friends are also using the service.

Dynamic Markets

Identifying substitute products can also be a complex proposal for antitrust regulators in the tech sector. Many distinct services can appear to be fulfilling different needs in a market but, in a matter of one update, can suddenly be competing directly. So, while it’s easy to discern that Coke and Pepsi are substitute products and competitors, services like Instagram and Snapchat are not so clear cut. These two social media technology companies started out offering different services, but their offerings have only recently started to overlap. When studying antitrust cases in the technology sector, regulators must make careful case by case analysis and tease out the details of each market.

How to measure effects

Lastly, recent antitrust claims have been evaluated by judges by considering whether a company’s practices have raised consumer prices. This means some tech companies have been permitted to grow while being overlooked by regulators because many of the services they offer are free to consumers.

Implications for individuals and market participants

As companies become large technology conglomerates, they increase their ability collect larger amounts of data from different aspects of our lives. So, a company like Alphabet has information from a user’s email, location data from their cellular phones, and browsing data collected through Chrome. This increased amount of data collection leaves consumers exposed to potential breaches by the companies, and violations of privacy.

Consolidation has also made it difficult for smaller startups to enter the market and innovate by creating new services. Many times, the choice that these smaller firms have is to either accept an acquisition by a much larger firm, or have their service cloned by the larger firm with more resources. In situations where firms have created markets, like advertising platforms, these large companies might be inclined to give unfair special pricing to certain businesses. In addition, vertically integrated tech companies may prioritize their own products to users within other products.

There is still much research left to be done on the effects of large tech companies on consumers, businesses and the markets in which they participate. What is clear is that antitrust regulators need a different approach to overseeing the industry. As we continue to have conversations about the ideal way to regulate large technology companies, we should consider different metrics than we have used in the past to measure their potential negative effects.

Works Cited

- Baker, Jonathan B. “Can Antitrust Keep Up?: Competition policy in high-tech markets” The Brookings Institution, https://www.brookings.edu/articles/can-antitrust-keep-up-competition-policy-in-high-tech-markets, (December 1, 2001).

- Finley, Klint. ìLegal scholar Tim Wu says the US must enforce antitrust lawsî, Wired Magazine, https://www.wired.com/story/tim-wu-says-us-must-enforce-antitrust-laws, (March 11, 2019).

- Hart, David M. “Antitrust and Technological Innovation.” Issues in Science and Technology 15, no. 2 (Winter 1999).

- “2018 Antitrust and Competition Conference.” Stigler Center for the Economy and the State, https://research.chicagobooth.edu/stigler/events/single-events/antitrust-competition-conference-digital-platforms-concentration, (April 19-20, 2018).

Image source

Image 1: LA Times

Infographic: https://howmuch.net/articles/100-years-of-americas-top-10-companies